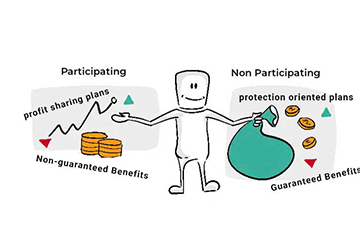

Differences Between Participating and Non-Participating Life Insurance Policies

Life insurance has many flavours, but two stand out: participating and non-participating policies. Confused? Don't worry—you're not alone.

Life insurance has many flavours, but two stand out: participating and non-participating policies. Confused? Don't worry—you're not alone.

These two policy types can shape your financial future in very different ways. Whether you're looking for potential cash bonuses or just straightforward coverage, there's a policy tailored for you.

But here's the thing—choosing between them isn't always easy. It's like choosing between a Swiss Army knife and a sturdy fixed-blade knife. Both are useful but in different situations.

That's why understanding the ins and outs of these policies is crucial. It's not just about protection; it's about making your money work smarter for you and your loved ones.

Ready to unravel the mystery? This post will explain participating and non-participating policies in plain English. Keep reading—your future self will thank you.

Understanding Life Insurance Policies

Life insurance is like a financial safety net for your loved ones. It's a contract between you and an insurance company. You pay premiums, and in return, they promise to pay out a sum of money when you die.

But it's more than just a death benefit. Life insurance can be a crucial part of your financial planning. It helps ensure your family's financial stability if you cannot provide for them.

Think of it as a backup plan for life's uncertainties. It can cover funeral expenses, pay off debts, or replace lost income. For some, it's peace of mind. For others, it's a way to leave a legacy.

Different life insurance policies exist, each serving unique needs and goals. Understanding these differences is crucial for making the right choice for your situation.

What is Participating in Life Insurance?

This type of policy is like having your cake and eating it, too. Are you intrigued? You should be.

Participating in life insurance is a unique beast. It's a policy that does double duty. On one hand, it provides the death benefit you'd expect from any life insurance. But here's where it gets interesting – it also lets you share in the insurance company's profits.

How does this work? When you buy a participating policy, you're not just a customer. You become a partial owner of the company's investment portfolio. It's like joining an exclusive club but with financial perks.

The insurance company invests your premiums. If those investments do well, you get a slice of the pie. These slices come in the form of dividends. Now, don't expect these dividends to make you rich overnight. They're more like a bonus on top of your regular coverage.

These dividends aren't guaranteed. They depend on how well the company performs. But when they do come, you've got options. You can take them as cash, reduce your premiums, or even buy more coverage.

The potential benefits are sweet. Your coverage can grow over time. Your premiums might decrease. And you might even build up some cash value that you can borrow against if needed.

What is Non-Participating Life Insurance?

Now, let's shift gears and talk about non-participating life insurance. If participating policies are like a rollercoaster ride, non-participating policies are more like a steady train journey. It's less exciting but reliable and predictable.

Non-participating life insurance is the no-frills option in the insurance world. It's straightforward and does exactly what it says on the tin. You pay your premiums, and in return, you get a guaranteed death benefit—no more, no less.

With these policies, what you see is what you get. There's no profit-sharing involved. The insurance company doesn't invite you to the party when their investments do well. They're not asking you to chip in when things go south.

The benefits are fixed from day one. You know precisely what your beneficiaries will receive. It's all spelt out in black and white in your policy document. No surprises, no fluctuations.

This certainty can be comforting. You're not at the mercy of the company's performance or the whims of the stock market. Your coverage remains steady, come rain or shine.

Non-participating policies often come with lower premiums. After all, you're not paying for the potential of extra benefits. It's like buying a car without all the fancy add-ons. You get from A to B, and that's what matters.

Critical Differences Between Participating and Non-Participating Life Insurance

Let's roll up our sleeves and get down to the nitty-gritty. We have participating policies in one corner and non-participating policies in the other. It's time to see how they compare.

Premiums and Costs

Think of participating policies as the gourmet meal of the insurance world. They often come with a heftier price tag upfront. Why? You're paying for that potential slice of the profit pie.

But here's the kicker:

● Over time, dividends might offset some of your costs

● You could even use dividends to pay premiums

● In some cases, your out-of-pocket costs might decrease

Non-participating policies? They're more like a fixed-price menu. You know precisely what you're paying; it usually stays the same. There are no surprises, but there are no potential discounts either.

Dividends and Returns

Participating policies are the overachievers of the insurance world. They don't just provide coverage; they aim to give you a little extra. How?

● Dividends: These are your share of the company's profits

● Potential cash value growth: Your policy might build up savings over time

● Options galore: You can reinvest dividends, take cash, or boost your coverage

Non-participating policies? They're the "what you see is what you get" type. No dividends, no profit-sharing. It's just straightforward coverage.

Risk and Stability

Here's where things get interesting. Participating policies are a bit like gambling but with better odds:

● Your returns can fluctuate based on company performance

● There's potential for higher returns, but also the risk of lower ones

● The death benefit might grow over time

Non-participating policies? They're the steady Eddies:

● Guaranteed benefits from day one

● No surprises (good or bad)

● Perfect for those who like their financial planning predictable

Flexibility and Benefits

Participating policies are the Swiss Army knives of insurance:

● Use dividends to reduce premiums

● Boost your death benefit

● Build cash value you can borrow against

● Adapt your policy as your needs change

Non-participating policies? They're more like a trusty hammer:

● They do one job, and they do it well

● Fixed benefits that don't change

● Less flexibility, but more certainty

Remember, there's no one-size-fits-all here. Your choice depends on your financial goals, risk tolerance, and how much you like (or don't like) surprises in your financial planning.

How to Choose the Right Policy for You?

Choosing between participating and non-participating policies differs from choosing between chocolate and vanilla. It's more complex, but don't sweat it. Here's a quick guide to help you decide.

First, look at your financial goals. Want potential growth? Participating might be your jam. Happy with fixed coverage? Non-participating could be the ticket.

Next, consider your risk tolerance. Can you handle some ups and downs? Participating policies suit you. Do you prefer predictability? Non-participating policies offer that steady hand.

Think about your long-term plans, too. Participating policies can grow with you, offering flexibility. Non-participating policies are more set in stone, but that stability can be comforting.

Lastly, remember your budget. Participating policies often cost more upfront but might pay off later. Non-participating policies are usually cheaper but offer no extras.

Remember, there's no "right" answer. It's all about what fits your unique situation.

Make an Informed Decision on Your Life Insurance

Now that you've got the lowdown on participating and non-participating policies, it's time to take action. Don't just file this information away—use it.

Your life insurance choice can significantly impact your financial future. It's not just about death benefits; it's about peace of mind and economic security.

Take a good look at your needs, goals, and risk tolerance. Then, reach out to a professional. An insurance advisor can help you navigate the ins and outs of these policies.

Remember, knowledge is power. Armed with this info, you can make an intelligent choice that fits your unique situation. Your future self will thank you for it.

Frequently Asked Questions

Q. What's the main difference between participating and non-participating life insurance?

Ans. Participating policies offer potential dividends and cash value growth, while non-participating policies provide fixed benefits without profit-sharing. Participating policies are more flexible but often pricier, while non-participating ones provide certainty at a lower cost.

Q. Do non-participating policies offer dividends?

Ans. No, non-participating policies don't offer dividends. They provide a guaranteed death benefit and fixed premiums without profit-sharing from the insurance company's investments.

Q. How do I decide which type of policy is best for me?

Ans. Consider your financial goals, risk tolerance, and budget. If you want potential growth and flexibility, look at participating policies. Non-participating policies might be better if you prefer predictability and lower costs.

Q. Are premiums higher for participating policies?

Ans. Generally, yes. Participating policies often have higher initial premiums because they offer potential dividends and cash value growth. However, dividends might offset some costs over time, potentially reducing out-of-pocket expenses.