What Is Parametric Insurance And How Does It Work?

Insurance is meant to provide a safety net when things go wrong, but traditional policies can be slow and frustrating when it's time to make a claim. Parametric insurance steps in as a faster and simpler alternative. This article will explain parametric insurance, how it works, and why it's gaining traction.

Insurance is meant to provide a safety net when things go wrong, but traditional policies can be slow and frustrating when it's time to make a claim. Parametric insurance steps in as a faster and simpler alternative. This article will explain parametric insurance, how it works, and why it's gaining traction.

What Is Parametric Insurance?

Parametric insurance is a type of insurance that pays out a fixed amount based on predefined conditions or triggers rather than covering specific losses. Instead of assessing and calculating damages, parametric insurance pays out when a particular event happens, regardless of damage or loss. It's not about proving how much you've lost; it's about whether the triggering event occurred.

For example, if you're a farmer worried about drought, a traditional insurance policy would require you to show proof of how much crop was lost, undergo an inspection, and wait for a payout based on the evaluation. On the other hand, Parametric insurance could be set to pay a fixed amount if rainfall in your area drops below a certain threshold over a specific period.

How Does Parametric Insurance Work?

The key to parametric insurance lies in the pre-agreed triggers. These triggers are often tied to measurable data, like weather patterns, seismic activity, or market indexes. When the trigger is met, the payout happens automatically, making the process quick and straightforward.

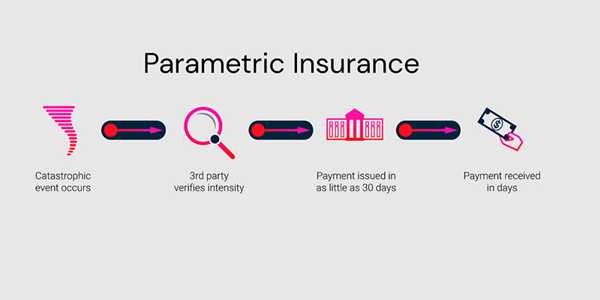

Here’s a simple step-by-step breakdown of how it works:

Setting the Trigger: The policy defines an event that would activate a payout. This event is typically something that objective data can easily measure. For weather-related insurance, it could be something like "rainfall below 10mm over 30 days."

Monitoring the Data: The conditions are monitored using reliable data sources. These could be government weather stations, satellite data, or other independent and trusted sources. The data is continually tracked to see if the trigger is met.

Payout Mechanism: If the predefined trigger is hit, the insurer automatically issues the payout, no questions asked. Since there's no need to assess individual losses, the process is much faster than traditional insurance.

Fixed Compensation: The payout is typically an agreed-upon amount when the policy is signed. This amount doesn't fluctuate based on the extent of the actual damage. The simplicity is the main appeal; the event, not the aftermath, triggers the payout.

Advantages Of Parametric Insurance

There are several reasons why parametric insurance is becoming more popular:

Speedy Payouts: Since there’s no need for lengthy investigations or damage assessments, payouts happen quickly—often within days or even hours.

Transparency and Simplicity: The triggers are based on precise, measurable data, so there's no ambiguity about whether a claim should be paid. The payout happens if the data shows the event occurred—no need for debates or lengthy disputes.

Fewer Administrative Costs: Traditional insurance can involve a lot of paperwork, inspections, and negotiations. Parametric insurance cuts out much of this, making it more efficient and potentially lowering costs for both the insurer and the insured.

Fills Coverage Gaps: Parametric insurance can cover difficult or expensive risks to insure through traditional policies. For example, businesses in regions prone to earthquakes might need help to get traditional coverage, but parametric insurance can offer them a simple, straightforward option.

Use Cases Of Parametric Insurance

Parametric insurance is versatile and can be applied in a range of situations. Here are some real-world examples:

Agriculture: Farmers are vulnerable to unpredictable weather. Parametric insurance can offer coverage based on rainfall levels, temperature ranges, or wind speed. If a drought or flood hits, the policy can pay out automatically.

Natural Disasters: Areas prone to earthquakes, hurricanes, or tsunamis can use parametric insurance to cover financial losses. The policy might trigger a payout if an earthquake of a particular magnitude strikes within a specific radius or a hurricane reaches a certain wind speed.

Travel: Some companies offer parametric insurance that provides instant compensation for flight delays or cancellations. If your flight is delayed by more than a few hours, you receive a payout immediately without needing to submit proof or haggle over your claim.

Business Interruption: Businesses impacted by power outages or supply chain disruptions can use parametric insurance to ensure quick cash flow during emergencies. For example, a manufacturer might set up a policy that pays out if a significant supplier in another region suffers from a weather event that disrupts deliveries.

Challenges And Limitations

While parametric insurance has a lot of benefits, it’s not without its challenges:

Basis Risk: One of the most significant issues is basis risk—the risk that the payout doesn't fully align with the actual loss. For instance, a farmer might receive a payout for a drought, but it might not be enough if the crop loss is much higher than anticipated. Conversely, the payout could be triggered even if the damage was minimal.

Complexity in Setting Triggers: Defining the right trigger can be tricky. It requires accurate data and careful analysis to ensure the trigger reflects the risks. Setting the right trigger could lead to more false claims or more coverage.

Regulatory Issues: In some regions, parametric insurance might need to fit neatly into existing insurance regulations. This could lead to complications in how policies are marketed and enforced.

Limited Awareness and Adoption: Although parametric insurance is growing, it's still relatively new. Many potential customers need to know or fully understand how it works, which can slow adoption.

Conclusion

Parametric insurance provides a quick, straightforward alternative to traditional coverage by offering automatic payouts based on predefined triggers, like weather events or market changes. It’s ideal for situations where speed and simplicity are crucial, such as natural disasters or business interruptions. While it doesn’t require damage assessments, it comes with challenges like basis risk and the need for accurate triggers. As technology and awareness improve, parametric insurance is gaining traction, filling coverage gaps and offering a faster, more transparent option for managing specific risks without the delays of traditional insurance.