7 Financial Planning Tips for Choosing the Right Commercial Insurance

As a business owner, safeguarding your assets, income, and operations is paramount. However, knowing the coverage could become tricky, mainly when financial considerations are being made.

As a business owner, safeguarding your assets, income, and operations is paramount. However, knowing the coverage could become tricky, mainly when financial considerations are being made.

Here's the good news: By integrating financial planning into insurance choices, one can make more rational choices that will provide better protection and economic stability.

This blog post will share seven planning tips for choosing the right commercial insurance. Keep reading to find tips to help your company confidently face the future.

The Power of Informed Decisions: Securing the Future of Your Business

Think of knowing that your business is protected against unforeseen risks. It will be time well spent when you reflect on how thoughtful financial planning is when choosing your commercial insurance, which ensures that your business is safe in the long run from unexpected risks.

Making the right insurance decision can be the difference between having a significant financial setback later on or not. It is not just about getting the cheapest policy but one that will be the best value for comprehensive protection.

The good news is that, with some research and guidance, you can easily navigate this process without being bankrupt or losing valuable time.

In this post, we share some of the following tips, which, if followed, should help you make empowering, informed decisions that safeguard your business's assets, reputation, and potential future growth.

7 Financial Planning Strategies for Commercial Insurance

Are you looking for the right commercial insurance but need to know how to choose the right one? We understand your concern, and that's why we are here to guide you through seven financial tips to select the right commercial insurance for you;

1. Assess Your Business Risks

First, thoroughly examine your business's unique risks before shopping for insurance. You should consider its industry, location, size, and business assets.

Spot potential threats, such as property damage, a liability claim, or business interruptions. Then, personalize insurance to cover your specific needs.

Consider the overall risk present. You can engage industry experts or risk management consultants to assist Ev.ery, which has its unique way of running things.

2. Determine the Right Coverage Types

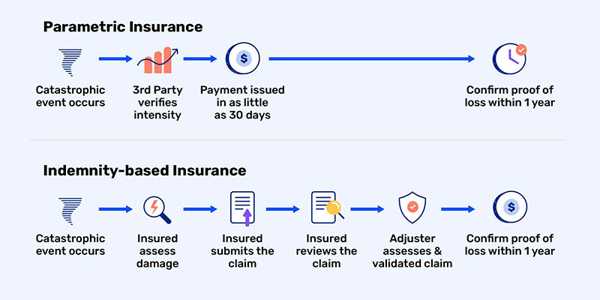

Commercial insurance may be a broad field with diverse options available, and they usually target different areas within your business. Such insurances generally include property, liability, worker compensation, and business interruption insurance.

Research and understand the various coverage options, ensuring you pay enough for what you are not using or leaving those critical areas unprotected.

Get to know the different types of commercial insurance. Match the types of cover required to your business's specific needs.

3. Shop Around and Compare Quotes

Don't settle for the first insurer you find. Shop around with several reputable companies and compare quotes before deciding.

You should consider much more than the bottom line in price: things like coverage limits, deductibles, the insurer's financial stability, and its customer service reputation.

Always ask for quotes from at least three different insurance providers.

Make the process more humane by using online comparison tools. Look for reviews and ratings from independent agencies such as AM Best or Standard & Poor's.

4. Consider a Business Owner's Policy (BOP)

A Business Owner's Policy (BOP) may be affordable for many small to mid-sized businesses to purchase necessary coverages in one bundle.

The average BOP includes property insurance, general liability, and business interruption insurance, all packaged together. Quite often, this is at a cheaper rate than individual purchases.

Assess whether a BOP is suitable for your size and needs. Customize your BOP with additional coverages as needed.

5. Review Your Coverage Regularly and Update

Your business is constantly changing, and so should your insurance. Reviewing your policies regularly, yearly, or during company-changing events is a good business practice.

This could involve adding new equipment, expanding to new locations, or hiring more employees. Regularly updating your coverage will ensure that you are always sufficiently protected.

Remind yourself to review your insurance policy every year and notify your insurance provider of any significant changes in your business.

6. Implement Risk Management Strategies

While insurance is a must, it is undoubtedly not the only way to protect your business. Proactive risk management strategies help reduce the possibility and impact of losses or damages. These strategies may involve actions such as safety protocols, frequent maintenance of equipment, and training employees.

Identify your business's significant risk areas. Develop and implement risk mitigation strategies. Regularly review and amend the risk management plan as necessary.

7. Work with a Trusted Insurance Professional

Navigating the world of commercial insurance may seem complex, but with the right help, it is manageable.

Partnering with a reliable insurance professional, such as an experienced broker or agent, can provide expert guidance and help you make informed decisions.

Research and vet potential insurance professionals. Choose someone with experience in your industry and business size, and establish open communication and a long-term trusting relationship with them.

Secure Your Business's Future Today: Take Action Now

In today's business landscape, having the correct commercial insurance is paramount. Financial planning is a forethoughtful step in securing your company's assets, reputation, and future growth.

Please don't wait until it is too late to act; act now. By doing so, you can make an enlightened decision that will safeguard your business from any sudden risks and losses.

Always remember, the peace of mind that ensues from knowing your business is adequately insured is priceless.

Please take your time with your business's future; get it on the right track with the best insurance.